The Biden administration is threatening to restart student loan payments during a pandemic on August 29th , 2023 . Are you ready to strike your student debt? Curious about striking? This is the place to start! Learn more about what the Debt Collective means by a “student debt strike” and the multiple ways you can get safely to nonpayment.

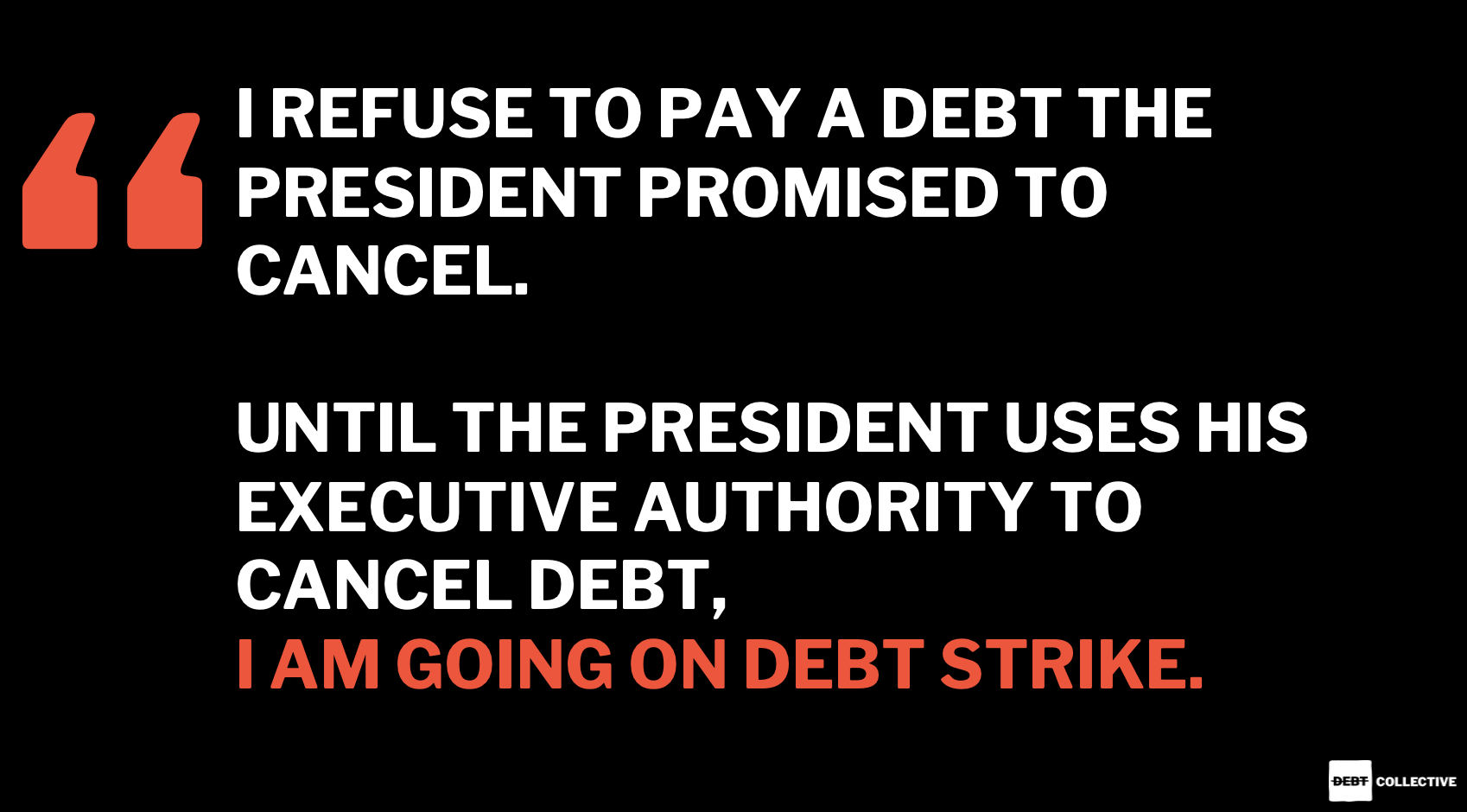

The Debt Collective defines a student debt striker as anyone who is paying $0 a month for a combination of economic and/or political reasons—because they can’t pay and know they shouldn’t have to pay—and who is committed to joining the fight for broad-based cancellation. A student debt strike is about politicizing nonpayment collectively. Instead of doing things as individuals, we are doing them together as a united front.

At the Debt Collective we believe that debt strikes are a central tactic in the arsenal of debtors’ unions. However, different debt types require different understandings of a strike. In a student debt strike, the main target is the federal government. The federal government is a unique target because we don’t actually hurt the government financially when we don’t pay our federal student loans. In fact, millions of people don’t pay their federal student loans every year! Since March 2020, most student debtors have paid nothing because of the payment pause! Even before the pandemic most people (about 55%) were paying $0 a month in one form or another. This proves the government doesn’t need our money and can easily cancel the debt.

You are already on strike! People who have already defaulted have already been forced to deal with the consequences of default. By declaring yourself on strike (instead of merely in default) you are politicizing and reframing your situation: this is not a matter of personal failure, it is collective resistance. The Biden administration has released some information on how it intends to deal with defaults going forward, but the details are still hazy. You can find the latest official information on the administration’s options for defaulted borrowers here.

This strike is for federal student loans. For the reasons explained above under “What Can I Do?” borrower power operates differently for federal vs. private student loans. Even though this specific strike is not targeted toward private loans, collective action on private loans can make some waves. You can join the Debt Collective’s Private Student Debtor’s list by filling out this form, and join the fight against private student loans.

The best way to strike your debt is to get it canceled. The law requires the government to cancel your debt if it finds that your school defrauded you. Did your school lie about job placement, or mislead you about the amount of debt you would be forced to take on? This kind of fraud was especially common at for-profit schools. If your school lied to you, and especially if you have debt from a school like Art Institute or DeVry, you should consider filing for borrower defense to repayment.

In theory, Public Service Loan Forgiveness (PSLF) is a way for student debtors who work for governments or nonprofits to have their loans canceled. In reality it is a broken promise and a failed policy. After the first people became eligible for cancellation, ninety-nine percent of them got denied PSLF. After Congress “fixed” the program, 99% got denied again. The latest attempt to fix PSLF was a temporary waiver. Although many people are finally getting the long overdue cancellation they were promised, many others have encountered problems with the waiver, and many more were not able to apply during the waiver period. The Student Borrower Protection Center has the best resources for navigating PSLF.

Income-driven repayment (IDR) is supposed to be a pathway to cancellation. So far, that has been a lie. But even though the cancellation aspect of IDR has not worked, IDR can be used to reach $0 monthly payments depending on income and family size. Before the pandemic, roughly half of all people enrolled in IDR had $0 monthly payments. You can put in your information to calculate your IDR payments here, and you can apply for IDR directly through the Department of Education.

According to Politico: “Education Department officials are planning a “safety net” period in which borrowers aren’t penalized for missing payments once repayment begins, according to three people familiar with the discussions. Officials had previously settled on a grace period for the first 90 days after payments are due. But they are now considering extending that flexibility to borrowers for as long as a year after repayment starts, according to two people familiar with internal discussions, who also cautioned that the plans are in flux and could change.”

If you are enrolled in school at least half time, you can get an in-school deferment for your federal loans. Depending on the type of loans you have, your loans may still accrue interest while you’re in school, but you will not be required to make payments. All current students are debt strikers and should join the strike.

It is not always possible to safely get to $0 monthly payments. Just like other direct actions and civil disobedience, the risks do not fall equally on everyone. If you are not able to get to $0 monthly payments safely, it is okay to do what you have to do to protect yourself. Some of these options might not get you all the way to $0 a month but could dramatically lower your monthly payment, and that might add a measure of protection for you and your family. There are other ways to organize and build pressure to win student debt cancellation.