We are a union of student loan borrowers harmed by the predatory for-profit college industry.

What is Borrower Defense?

Borrower Defense to Repayment is a federal student loan cancellation program that allows borrowers to seek cancellation of their federal student loans if their school misled them or engaged in misconduct. This includes practices such as false advertising, inflated job placement or earnings claims, deceptive recruitment tactics, or other forms of fraud.

Currently, the U.S. Department of Education is reviewing more than 450,000 pending Borrower Defense applications, alongside ongoing investigations that involve thousands of pages of evidence documenting misconduct by multiple predatory institutions.

At the same time, for-profit education lobbyists continue to exert outsized influence over what remains of the Department of Education. Prioritizing shareholder profits over borrower relief and working to preserve a system that keeps millions trapped in lifelong debt.

Many borrowers are further harmed by being pushed into private or institutional loans, where protections are limited and accountability is scarce. Loan servicers increasingly fail to meet their obligations, with borrowers facing impossible wait times, unanswered complaints, and delayed or denied relief. Veterans and marginalized groups are intentionally targeted.

Borrower Defense is not just a legal process, it is a collective fight for accountability, transparency, and justice. By coming together, sharing information, and organizing, borrowers can reclaim power from corporate actors that have profited from deception and exploitation.

We want every defrauded borrower made whole.

CHECK OUT OUR BORROWER OFFENSE CAMPAIGN: borroweroffense.org

Join Our Monthly Borrower Defense Calls

Stay informed. Get support. Take action.

Our Monthly Borrower Defense Calls are designed for borrowers navigating fraud, misconduct, and student loan injustice. Each call provides timely updates on the Borrower Defense landscape, current litigation, and policy developments—alongside practical guidance on asserting your rights and filing claims.

These calls are both educational and action-oriented. You will have space to ask questions, learn from others with similar experiences, and connect with a community working collectively to challenge predatory student lending.

Throughout the year, we will also host guest speakers from partner organizations, including advocates working in policy, legal aid, and borrower defense support, to share expertise, updates, and opportunities for coordinated action.

Whether you are just getting started or have an open case, these calls are for you.

REGISTER FOR AN EVENT!

Upcoming Borrower Defense Events

The History: Why This Fight Matters

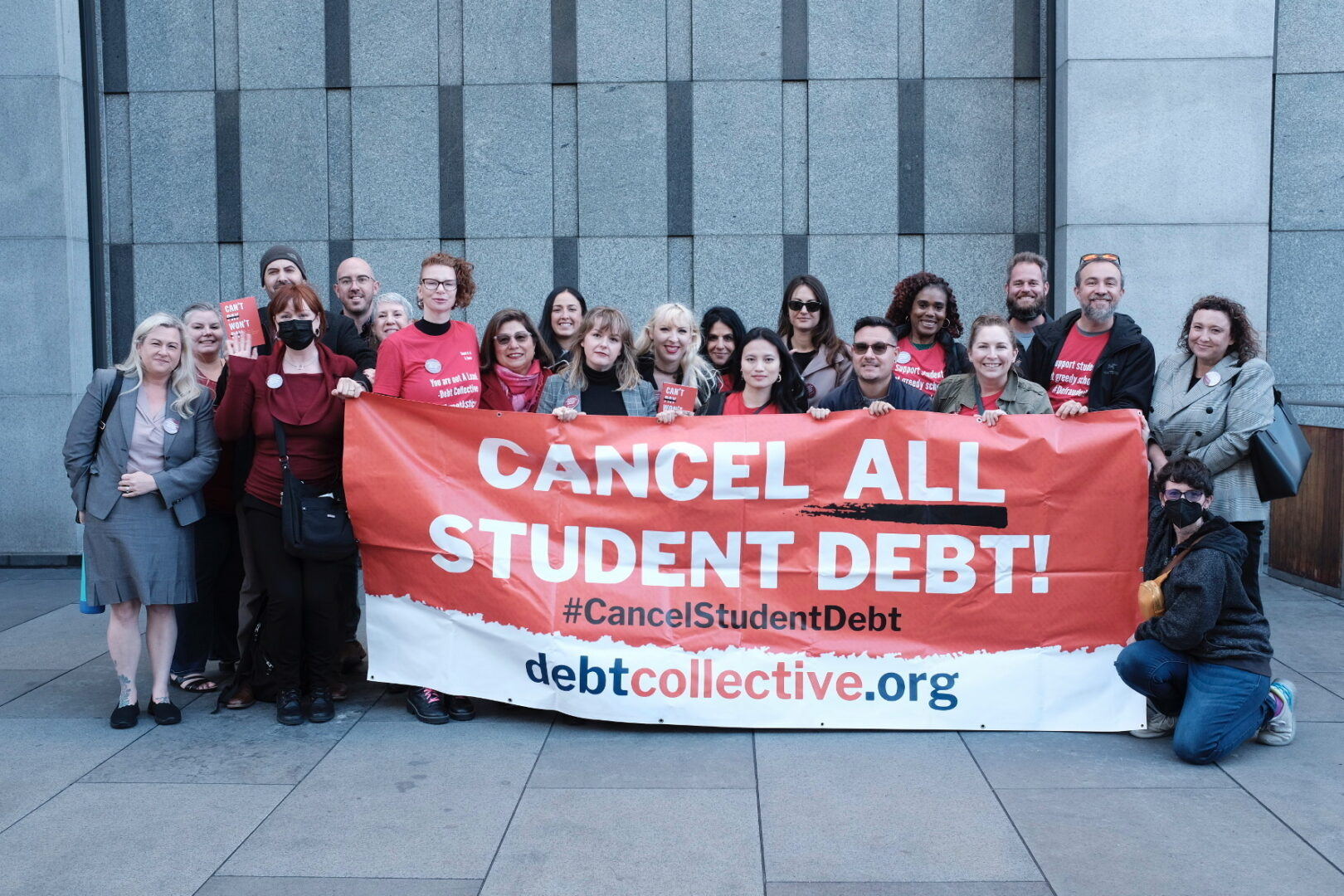

The Debt Collective has deep roots in organizing for-profit college borrowers. This is not the first time borrowers have been abandoned by political leadership, or forced to defend themselves against a system designed to protect corporate interests over people.

In 2015, the collapse of Corinthian Colleges exposed the scale of fraud embedded in the for-profit college industry. More than 16,000 students were stranded overnight, faculty went unpaid, and records became inaccessible. Even those who completed their programs found their degrees devalued and employment opportunities denied. While regulators later won more than $1.6 billion in judgments against Corinthian, borrowers were left holding debt for worthless degrees.

That collapse became the catalyst for modern Borrower Defense organizing.

Out of the Occupy Wall Street movement, Debt Collective founders launched Rolling Jubilee and Strike Debt. Purchasing distressed debt for pennies on the dollar and canceling it outright. In 2014, they turned their focus to Corinthian borrowers, canceling $3.8 million in private loans for 2,700 Everest College students and helping borrowers organize collectively. This effort gave rise to the Corinthian 15 Debt Strike, whose refusal to repay fraudulent loans drew national attention.

While searching for relief options, organizers uncovered a little-used provision buried in the Higher Education Act: Borrower Defense to Repayment. At the time, there was no application and no clear process. Debt Collective created and circulated the first Borrower Defense application. Forcing the Department of Education to respond. In 2016, the Borrower Defense Unit was formally established and new regulations were issued.

Progress was repeatedly undermined.

Under the Trump administration, Borrower Defense was effectively halted. Applications went unprocessed, regulations were rewritten to favor schools, and mass denials were rubber-stamped without explanation. Borrowers organized again, this time alongside the Project on Predatory Student Lending (PPSL), which filed the landmark Sweet v. DeVos lawsuit. In 2020, a federal judge rejected the Department’s handling of claims as “Kafkaesque,” rescinded denials, and forced accountability.

That organizing led to historic relief. Between 2021 and 2022, the Department of Education canceled billions in student loan debt for hundreds of thousands of borrowers defrauded by Corinthian and other predatory institutions. The Sweet settlement established clear timelines, automatic relief for many borrowers, and ongoing court oversight—though enforcement has required constant pressure, and many borrowers are still waiting today.

Organizing did not stop.

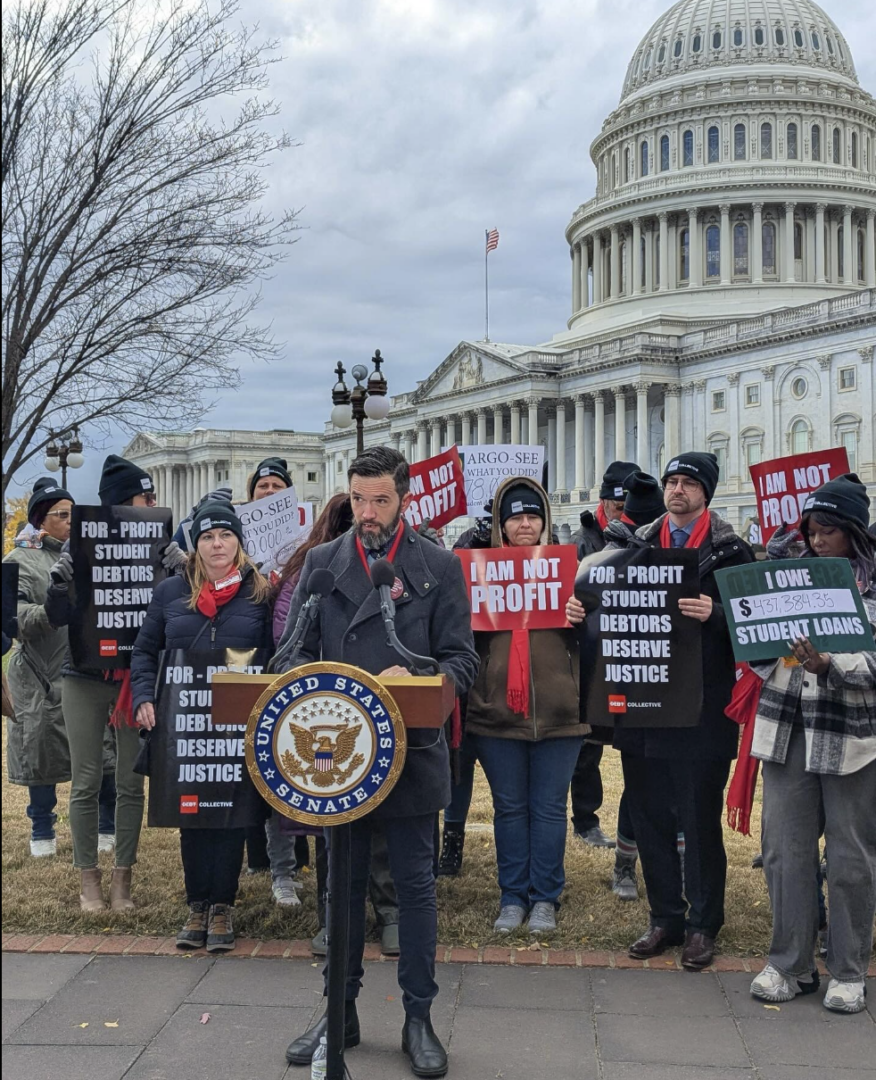

In 2024, Debt Collective launched the Borrower Offense campaign. Supporting borrowers in compiling school-specific evidence of misconduct and pressing regulators and lawmakers for accountability. These efforts directly contributed to further discharges, including full cancellation for Art Institute borrowers, and elevated investigations for other schools.

Today, borrowers once again face an openly hostile political environment, renewed attacks on the Department of Education, and attempts to dismantle oversight entirely.

The lesson is clear: relief only happens when borrowers organize, apply pressure, and act collectively.