A people’s investigation into how Career Education Corporation funneled millions of tax dollars through Brooks Institute and other schools into shareholder profits and created a lifetime of crushing debt for thousands of student loan borrowers.

EXECUTIVE SUMMARY

This white paper documents predatory lending and the defrauding of thousands of students who attended Brooks Institute of Photography, in Santa Barbara, California, between 1999 and 2016. It combines extensive data and testimony from nearly 500 former students at Brooks, dozens of lawsuits against Brooks and its parent company, Career Education Corporation (CEC), and media investigations of both Brooks and CEC.

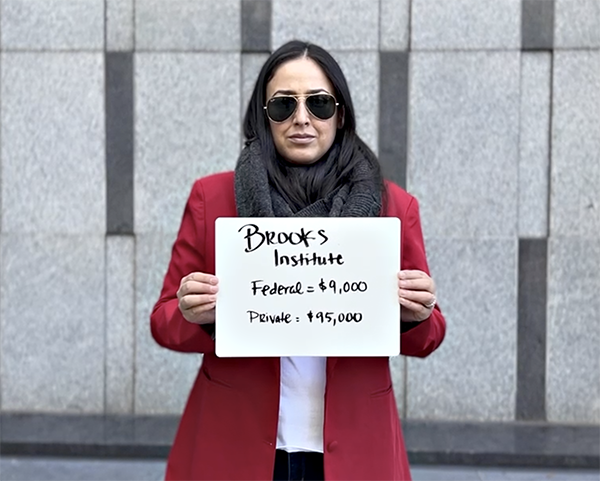

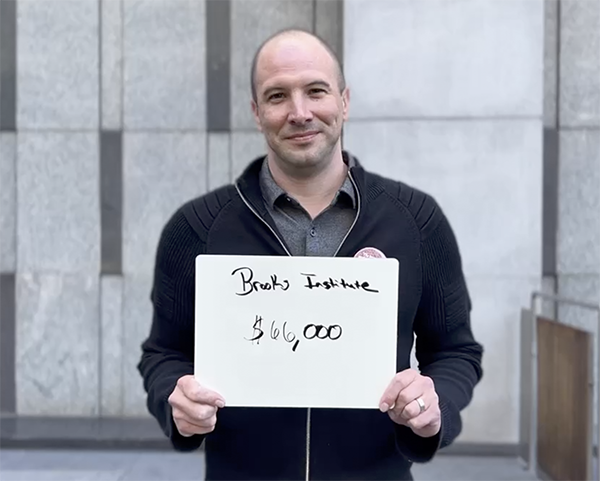

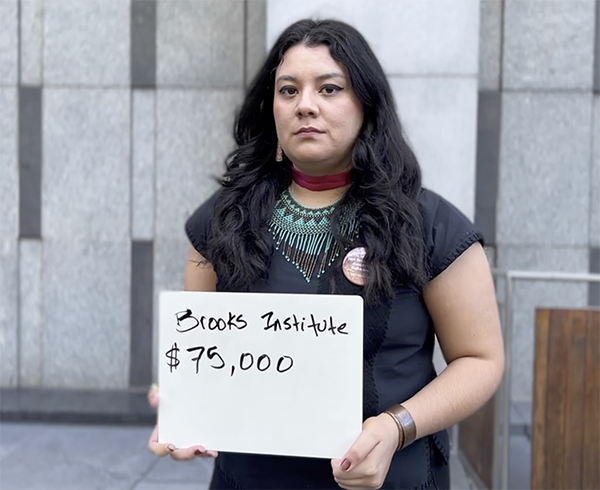

As students and former employees report, recruiters routinely relied on deception to enroll students and persuade them to take out both federal and private loans. The practices alleged and documented here included the following:

- Lying about graduation rates, job placement rates, and potential salaries on graduation

- Lying about available grants, scholarships, and financial aid

- Enrolling students regardless of their qualifications and ability

- Failing to properly inform students about loan options available and the differences between federal and private student loans

- Misleading students about the actual costs of education at Brooks

- Misleading students about accreditation and the transferability of credits

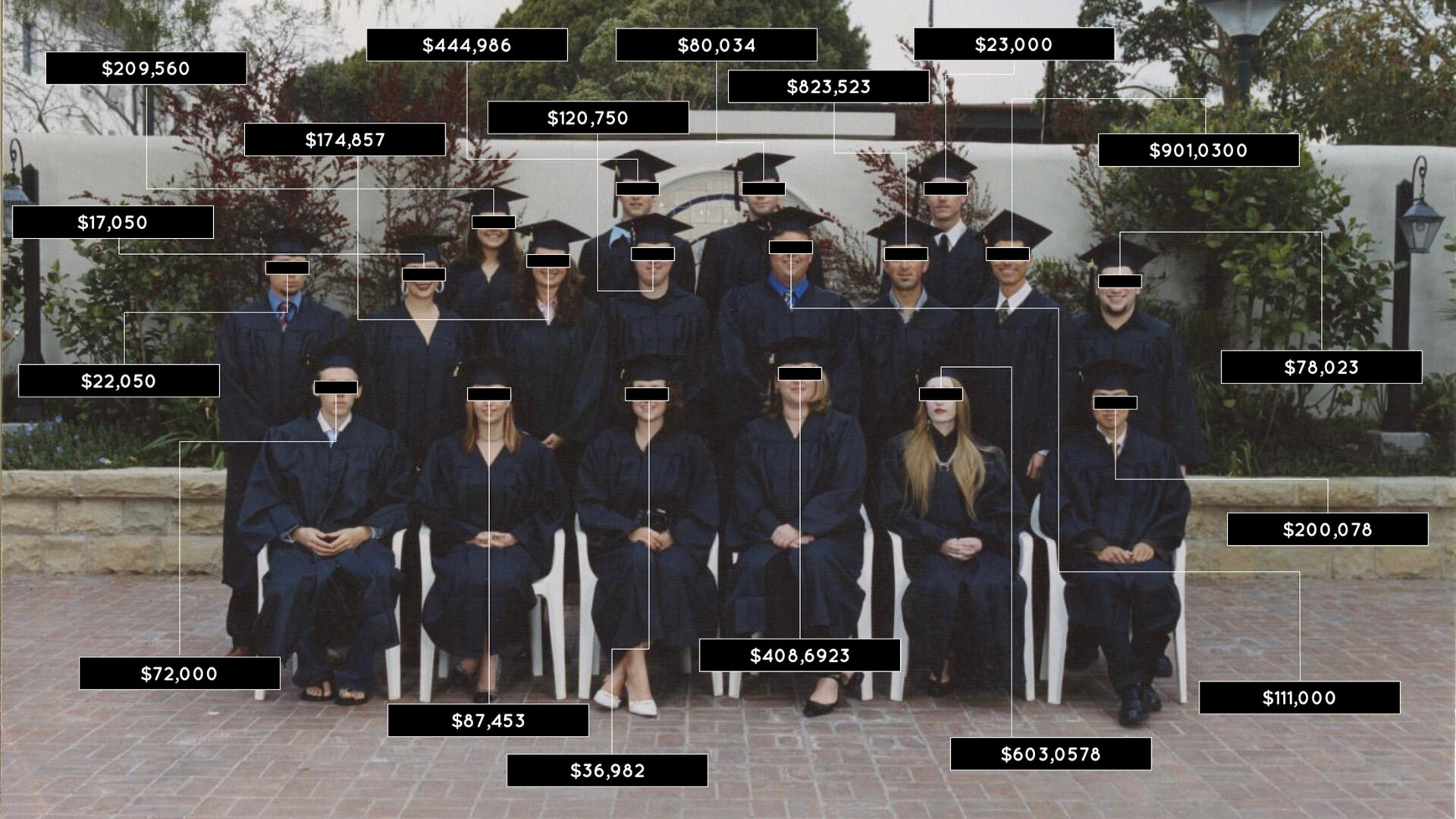

After graduation, many Brooks students found it completely impossible to afford student loan payments on their actual salaries. In our sample, average debt was over $143,000 and some had balances in the hundreds of thousands of dollars.

They describe here the catastrophic effects that their debt has had, not only on their own lives but also on their loved ones, including co-signers, parents, spouses, and children. Many lives have been simply ruined by the predatory lending at Brooks.

Brooks borrowers have sought various remedies, including through individual and class-action lawsuits against Sallie Mae, Brooks, and CEC, but these have brought very limited and inconsistent relief. The Department of Education’s Borrowers Defense to Repayment program has not worked thus far.

We hold the Department of Education accountable for its negligence, for enabling the for-profit education industry as a whole and CEC in particular. It has been too often corrupted and even staffed by industry insiders. We demand a swift and meaningful remedy for the harms that we continue to suffer as a result of the fraud and predatory lending clearly documented here.

We are asking for the Department to do the right thing by providing a group-wide discharge that cancels, all of the outstanding federal student loans for every single student who attended Brooks Institute and, refunds for payments made on these fraudulent debts, removal of all loans from credit reporting and return of Pell and GI benefits by the end of 2024.

CO-SPONSORS

These organizations and lawmakers have backed our mission to cancel all outstanding loans for Brooks Institute.

COMING SOON!

READ THE REPORT

60 pages on why the DoED should cancel all loans for Brooks Institute

4600+ Pages of Evidence

On May 22, 2024 we delivered our evidence to the US Department of Education. We asked them to please cancel all Brooks student loans.

CO-SPONSORS

This could be you! Do you feel all Brooks Institute Borrowers should be free from their predatory debt?

Use the form below to become a co-sponsor

WRITTEN BY:

ASHLEY PIZZUTI

BORROWER OFFENSE TO CANCELATION

What is Borrower Offense?

Borrower Offense is an aggressive plan to appeal to the Department of Education for student loan cancellation for a number of proven bad actor For-profit schools as quickly as possible.